A new scientific study titled “The electric vehicle transition and vanishing fuel tax revenues,” conducted by Bessie Noll, Tobias S. Schmidt, and Florian Egli and published in the journal Nature Sustainability, points out that the accelerated global adoption of electric vehicles is substantially reducing tax revenues from fossil fuel taxes.

This phenomenon is exposing government budgets and forcing countries, including several in Latin America, to rethink their tax systems to avoid growing tax gaps and ensure the financing of key public infrastructure.

You may also be interested in | Electrification, Data, and Partnerships: Latam Mobility Promotes the Future of Transportation on the “2026 Tour”

A Global Phenomenon with Fiscal Implications

The transition to electric vehicles (EVs) has gained momentum worldwide. As internal combustion engine cars are no longer the standard and EV sales increase year after year, traditional sources of tax revenue, such as gasoline and diesel taxes, are declining.

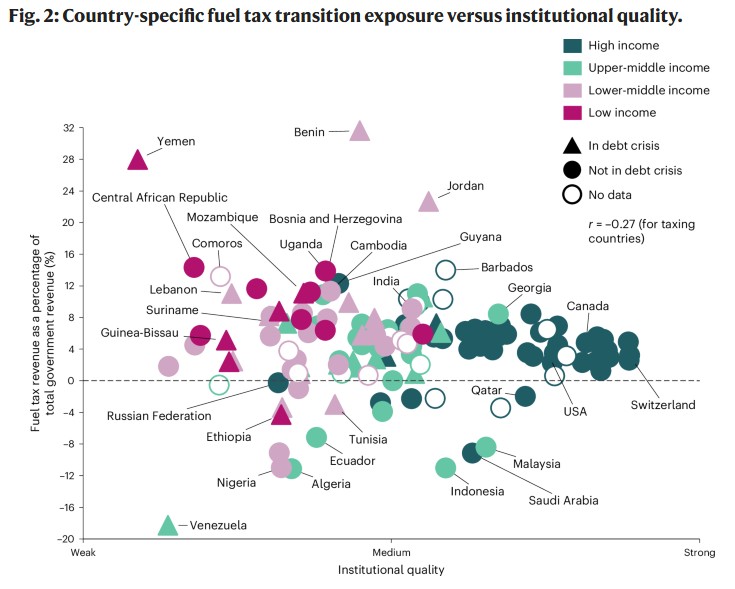

The study collects data from 168 countries and estimates that in 2023, public revenues from fuel taxes reached around USD 920 billion, a figure that is already beginning to erode as the electrification of transport grows.

This decline in revenue poses significant budgetary challenges for governments that rely on these resources to finance road infrastructure, public transport, and other essential services.

The transition to EVs, while positive from an environmental perspective, is also transforming the global economic and fiscal landscape with profound and urgent consequences.

Disparities among Countries and Fiscal Exposure

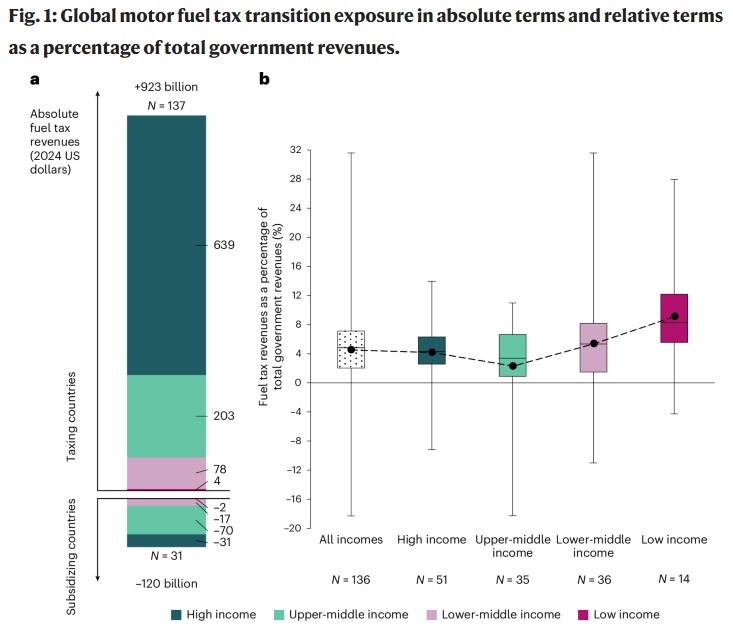

The analysis reveals that fiscal exposure, measured as the share of total government revenue that comes from fuel taxes, varies considerably depending on a country’s income level.

In low-income countries, fuel taxes account for a significantly larger share of total government revenue than in high-income economies, making them more vulnerable to the loss of this source of revenue.

In addition, many lower-income countries face additional institutional and financial challenges, such as debt crises or low administrative capacity, which limit their ability to implement complex tax reforms quickly.

This contrasts with nations with greater institutional capacity, which are better positioned to adapt and diversify their fiscal mechanisms as fuel revenues decline.

Projected Fiscal Trends and Risks

The study highlights that the accelerated transition to electric vehicles will continue to reduce demand for fossil fuels for transportation, leading to an even greater decline in gasoline and diesel tax revenues in the coming years.

Although the growth of electrification depends on multiple factors, such as charging infrastructure, public policies, and vehicle costs, the trend points to a sustained reduction in traditional fuel revenues.

The implications of this phenomenon are not uniform: while some governments have modern fiscal tools to adjust their revenue collection, others (particularly emerging economies) face a more complex landscape, with a greater risk of budget deficits if preventive action is not taken.

Faced with this challenge, various governments are exploring or implementing fiscal alternatives that will offset the loss of fuel tax revenue without slowing down the energy transition. Some of the options under discussion include:

- Infrastructure usage taxes, such as mileage rates that adapt to a more electrified vehicle fleet.

- Specific taxes on electric vehicles or differentiated annual fees, allowing EVs to also contribute to the financing of the road network.

- Broader tax reforms, incorporating mechanisms that balance environmental sustainability and fiscal sustainability.

These strategies seek to maintain the revenue necessary for public investment without discouraging the use of clean technologies, although their implementation requires detailed analysis of equity, administrative capacity, and economic effects.

Impact in Latin America

In Latin America, where the adoption of electric vehicles is in its early stages compared to regions such as Europe or China, the discussion on how to adjust tax structures has already begun to take shape.

Some countries have introduced tax incentives for EVs, such as temporary tax exemptions or tax credits, with the aim of encouraging adoption while protecting public revenue.

However, the region faces particular challenges: high import costs, limited charging infrastructure, and reduced tax margins, which make it more urgent to design tax frameworks that balance incentives for electrification with sustainable and equitable sources of revenue.

Therefore, the evidence gathered by the study shows that it also profoundly transforms the tax collection systems that many governments have used for decades.

To avoid fiscal gaps and ensure continued investment in infrastructure and public services, countries must move toward more flexible tax frameworks that are adapted to the context of electric mobility.

This implies not only reforming existing taxes and fees, but also considering innovative mechanisms that maintain the equity and efficiency of the tax system in a world with increasingly electrified transportation.

The Place to Understand and Accelerate the Transition

In this context of regional transformation, Latam Mobility invites you to be part of the 2026 Meeting Tour, a key platform for gaining in-depth knowledge of market developments, technological trends, business models, and investment opportunities that are defining the future of sustainable mobility in Latin America.

The tour will visit the region’s main markets: Monterrey and Mexico City, Brazil, Colombia, and Chile. Throughout these meetings, leaders from the public and private sectors, companies, investors, and international experts will analyze the present and future of electric mobility, technological innovation, infrastructure, energy, and the climate economy.

The transition is already underway. The Latam Mobility 2026 Tour will be the meeting point to accelerate decisions, connect key players, and collaboratively build sustainable mobility in Latin America.