Record Rotation in Brazil: Used Electric Cars Cut Resale Time in Half Compared to Combustion Vehicles

The market for pre-owned cars in Brazil is undergoing a growing transformation, with electric vehicles beginning to stand out for their quick resale compared to traditional combustion models.

According to the Market Watch Brazil report, prepared by Indicata, some electric models are resold in less time than the flex hatchbacks that are widely established in the country, reflecting a clear acceptance of electric technology among Brazilian consumers.

You may also be interested in | Carbon Tracker: Brazil could save up to US$250 billion by accelerating the electrification of transport

The Fastest in the Pre-Owned Market

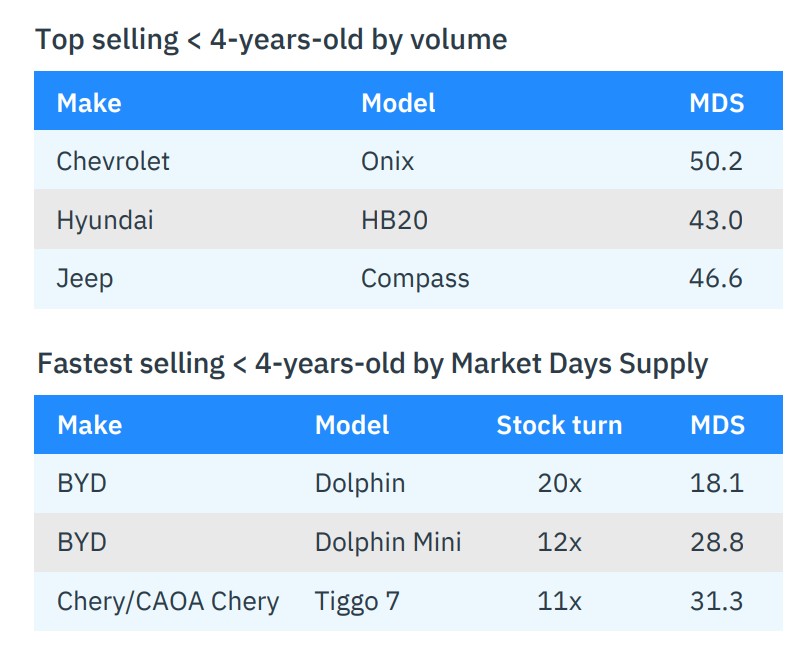

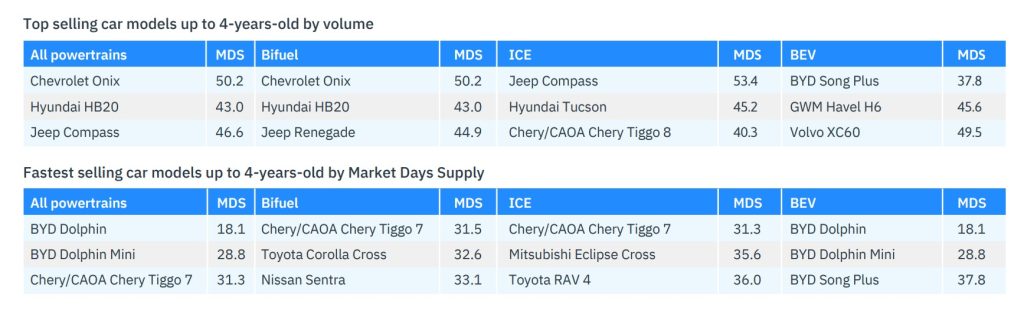

In the segment of vehicles up to four years old, the BYD Dolphin has a Market Days Supply (MDS) of only 19 days, while the Dolphin Mini reaches 24.9 days and the Song Plus completes the group with 31.7 days.

In practice, this means that these cars remain advertised for less time before sale than the leading flex hatch models on the market.

To put this into perspective, leading models in pre-owned sales volume, such as the Chevrolet Onix, Hyundai HB20, and Volkswagen Polo, have an MDS between 46.9 and 54.8 days.

The study indicates that when the product offering and price are aligned, an electric car can achieve higher liquidity than traditional models, demonstrating the growing maturity of the electric segment in Brazil.

However, despite high turnover performance, 100% electric cars still constitute a small portion of the pre-owned market. Nevertheless, sales behavior shows that the market does not reject electric technology, but rather selects the best offers.

Vehicles that are well positioned in terms of price, range, and warranty sell quickly, while those with misaligned characteristics require more time in stock and price adjustments.

This dynamic shows that the liquidity of electric vehicles depends on the consistency of the offer, not just the motorization, reflecting the evolution in consumer perception of electric mobility.

Two-speed Market in Brazil

The report also identifies that the pre-owned market operates at two speeds. On the one hand, older vehicles and flex-fuel models maintain a solid liquidity base, accounting for the majority of transactions.

On the other hand, electric and other recent technological models still represent a smaller volume, but stand out for their speed of sale and ability to attract buyers when the offer is right.

Cars that are five years old or older account for more than half of transactions, reflecting rational decisions in the face of high prices and limited credit. Pre-owned vehicles up to two years old, although newer, are losing relative market share.

The study highlights that the fall in prices of electric vehicles does not indicate a rejection of the technology, but rather a realignment after a period of initial overvaluation.

While flex-fuel models remain more resilient, electric, diesel, and gasoline vehicles are undergoing more obvious adjustments, consolidating a more rational and mature market, where liquidity depends on the consistency of supply and consumer confidence.

Chinese Brands Drive the Transition

Chinese brands such as BYD, GWM, Omoda, GAC, Leapmotor, and MG still have a limited presence in terms of volume, but they are already influencing consumer perception by raising standards for technology, equipment, and warranties.

According to the report, the real test will come in 2026, when vehicles from leasing contracts begin to enter the pre-owned market, consolidating the transition to electric mobility. For now, these brands are signaling the trend, without yet dominating the market.

Market Watch Brazil concludes that pre-owned electric cars can already compete effectively with traditional vehicles, provided they offer fair prices, clear usage proposals, and perceived reliability.

The rapid turnover of models such as the BYD Dolphin and Dolphin Mini shows that, although still a minority, the electric segment has consumers ready to adopt electric mobility, consolidating the trend toward gradual electrification in the Brazilian market.

El espacio para entender y acelerar la transición

En este contexto de transformación regional, Latam Mobility invita a ser parte de la Gira de Encuentros 2026, una plataforma clave para conocer en profundidad la evolución del mercado, las tendencias tecnológicas, los modelos de negocio y las oportunidades de inversión que están definiendo el futuro de la movilidad sostenible en América Latina.

La gira recorrerá los principales mercados de la región: Monterrey y Ciudad de México, Brasil, Colombia y Chile. A lo largo de estos encuentros, líderes del sector público y privado, empresas, inversionistas y expertos internacionales analizarán el presente y futuro de la movilidad eléctrica, la innovación tecnológica, la infraestructura, la energía y la economía climática.

La transición ya está en marcha. La Gira 2026 de Latam Mobility será el punto de encuentro para acelerar decisiones, conectar actores clave y construir, de forma colaborativa, la movilidad sostenible de América Latina.