Brazil Closes 2025 with New Electromobility Record: ABVE Electrified Vehicles Grow 10 Times More Than the Total Market

According to data from the Brazilian Electric Vehicle Association (ABVE), the Brazilian market for light electrified vehicles reached another milestone in 2025 and confirmed that the transition to new technologies is no longer a promise for the future, but a consolidated reality.

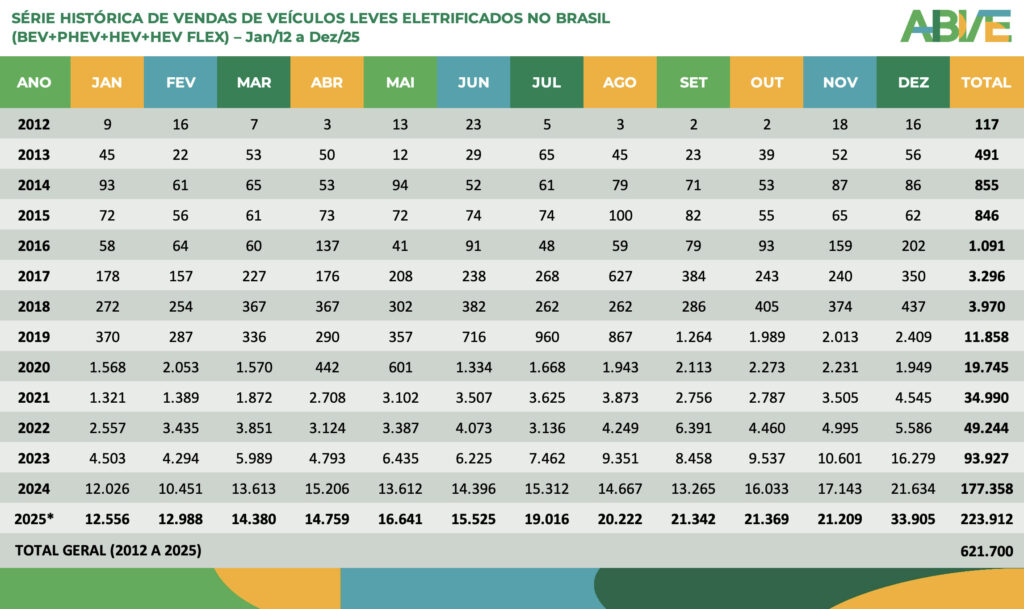

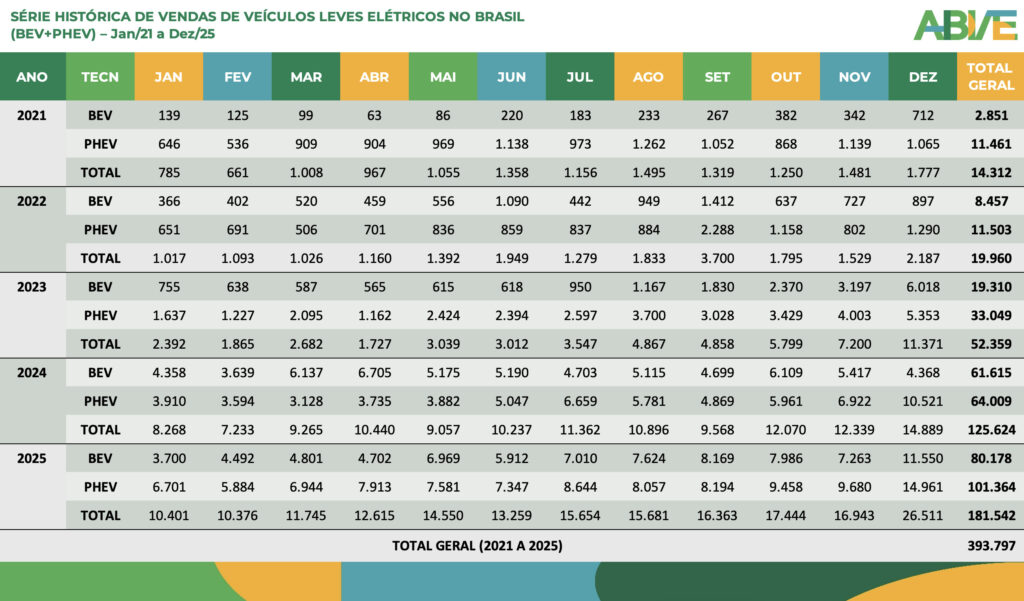

With 223,912 units sold during the year, the segment reached its highest volume ever and grew 26% compared to 2024, the entity said.

This performance contrasts sharply with the automotive market as a whole, which grew by just 2.6% in the same period.

You may also be interested in | Latin America accelerates in electric mobility: challenges and opportunities for 2026

Historic Year-end for Electromobility

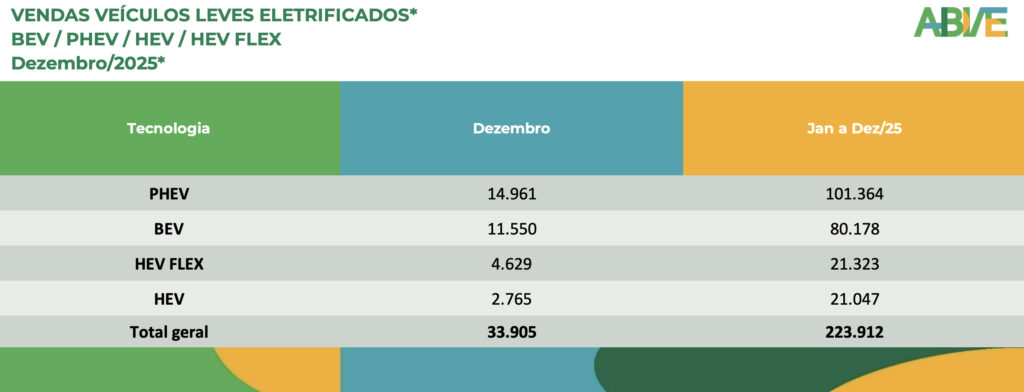

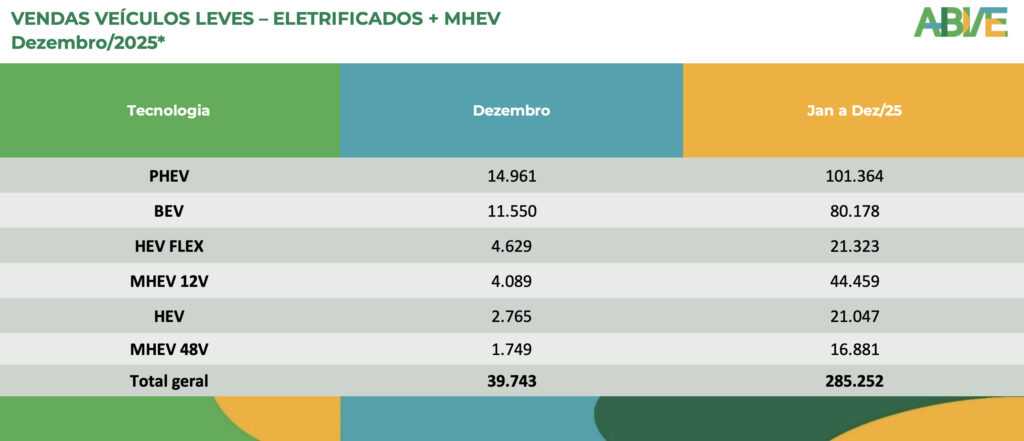

The definitive boost came in December, which became the best month ever recorded for electrified vehicles in Brazil.

In that month alone, 33,905 units were registered, a 60% jump from November and 57% from December 2024.

Market share reached 13% of all light vehicle sales in the country, an unprecedented level in the ABVE‘s historical series and a clear sign of the sector’s maturation.

In the year to date, electrified vehicles accounted for 9% of total light vehicle sales in Brazil, in a market that closed 2025 with 2.55 million units sold.

ABVE: 10 times faster

The contrast between the performance of electrified vehicles and the rest of the market is one of the main indicators of the structural change the industry is undergoing.

While total light vehicle sales in Brazil grew by just over 2% between 2024 and 2025, electrified models advanced at a rate ten times higher.

For ABVE, this differential confirms that the adoption of new technologies continues even in a more challenging macroeconomic context, especially during the second half of the year.

Beyond the record volume, the sector surpassed the symbolic barrier of 200,000 electrified vehicles sold in a single year for the first time.

The historical contrast is telling: in 2016, the market celebrated reaching just over 1,000 units; a decade later, cumulative growth exceeds 20,000%.

Another decisive factor was the start of local production of pure electric and plug-in electric vehicles.

During 2025, new industrial plants began operating, such as GWM in Iracemápolis (São Paulo), BYD in Camaçari (Bahia), and the multi-brand hub in Horizonte (Ceará), where production of General Motors models began.

This location of manufacturing strengthens the value chain, drives job creation, and reduces barriers to consumer access.

More Models and the Dominance of EV

The expansion of the offering was also decisive. Throughout 2025, nearly 400 different electrified models were marketed in the country, 26% more than in 2024, according to ABVE.

This greater diversity made it possible to cater to different consumer profiles and price ranges, accelerating adoption outside the traditional high-income niches.

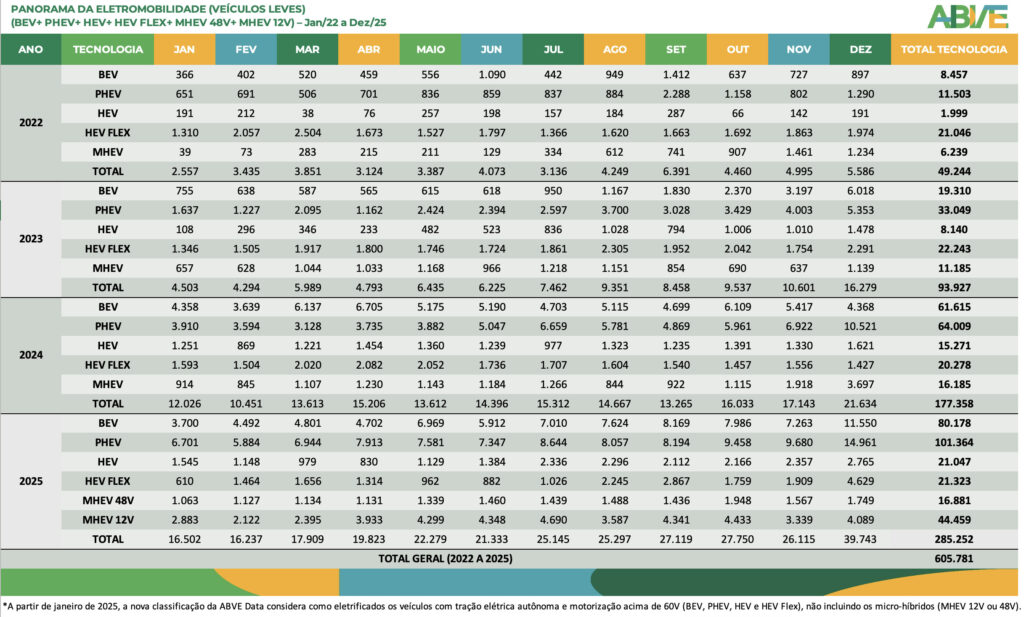

Plug-in electric vehicles, which include both 100% electric (BEV) and plug-in hybrid (PHEV) vehicles, accounted for the bulk of the growth.

In December, they accounted for 78% of electrified sales, with 26,511 units, and in the annual total they reached 181,542 vehicles, equivalent to 81% of the segment’s total.

Plug-in hybrids led the market throughout the year, with 101,364 units sold, an increase of 58% over 2024.

BEVs, meanwhile, closed 2025 with 80,178 units, a 30% year-on-year growth and a share of close to 36% of total electrified vehicles.

The Role of Hybrids and Micro-hybrids

Hybrids without external charging, both gasoline HEVs and Flex HEVs, also showed positive growth.

In December, they accounted for 22% of monthly electric vehicle sales and closed the year with 42,370 units, equivalent to 19% of the total, according ABVE.

The greatest momentum was seen in Flex HEVs, driven by their adaptation to ethanol use and a wider range of models.

And although they are not included in the ABVE’s main tally of electrified vehicles, micro-hybrid vehicles (MHEVs) showed remarkable growth.

In 2025, more than 61,000 units were sold, almost four times more than in 2024, a growth explained by the arrival of new models and light electrification strategies by automakers.

Distributed Electric Mobility

From a geographic perspective, the Southeast continues to be the main hub of Brazilian electric mobility, accounting for 46.4% of sales in 2025.

However, its share is gradually declining in the face of progress in other regions. The South consolidated its second place, while the Northeast managed to position itself as the third region with the highest sales volume, surpassing the Midwest in the annual balance.

This movement reflects a slow but steady deconcentration of the market, although the capitals still account for just over half of the registrations of electrified vehicles in the country.

For ABVE, the central message conveyed by the 2025 figures is clear: electrified vehicles have already won the trust of Brazilian consumers.

With sustained growth, industrial investments, greater model diversity, and an increasingly widespread presence throughout the country, electromobility is consolidating its position as the most innovative and dynamic segment of the country’s automotive market.

In this context, 2026 is shaping up to be a key year for deepening the technological transition, with new launches, increased local production, and an increasingly relevant role for Brazil within the regional map of low-emission mobility.

2026 as a Year of Consolidation

Rather than ambitious announcements, 2026 will be a year for measuring results. Electric and low-emission mobility will no longer be evaluated by the number of pilot projects but will be judged by its ability to operate at scale, reduce real emissions, and improve the quality of urban life.

For Latin America, the challenge will be to capitalize on its experience in electric public transportation, close infrastructure gaps, and build stable policies that allow the transition to be not only green but also inclusive and economically viable.

With the 2026 Tour, Latam Mobility reaffirms its commitment to building a regional agenda that connects vision, public policy, innovation, and the market.

Through its stops in Monterrey and Mexico City, Brazil, Colombia, and Chile, the platform will continue to promote a collaborative approach to accelerate the transition to cleaner, more efficient, and more inclusive transportation systems, positioning Latin America as a relevant player in sustainable mobility at the global level.

Be part of the movement that is accelerating Latin America’s energy and urban transformation. If you would like to learn more about how to participate and positioning options, click here.