Global Battery Sales to Increase More than 3 Times by 2030

Global battery sales for electric vehicles (EVs) will increase 3.7 times by 2030, according to a report by U.S. consulting firm Bain & Company.

In 2023, 10 million of these batteries were sold, a figure that will rise to 37 million within six years, according to the report, “Navigating the Electric Vehicle Battery Ecosystem,” released this month.

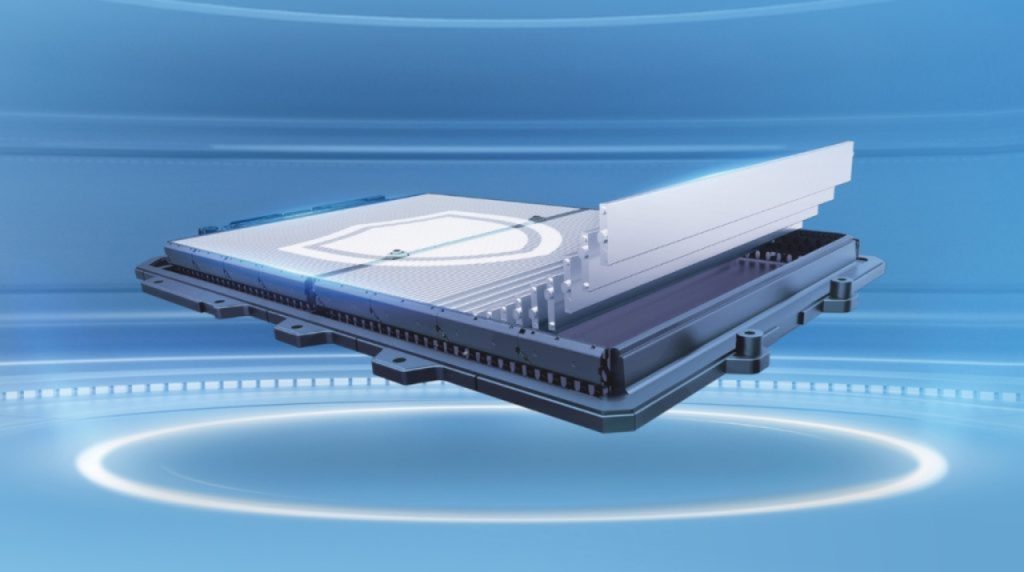

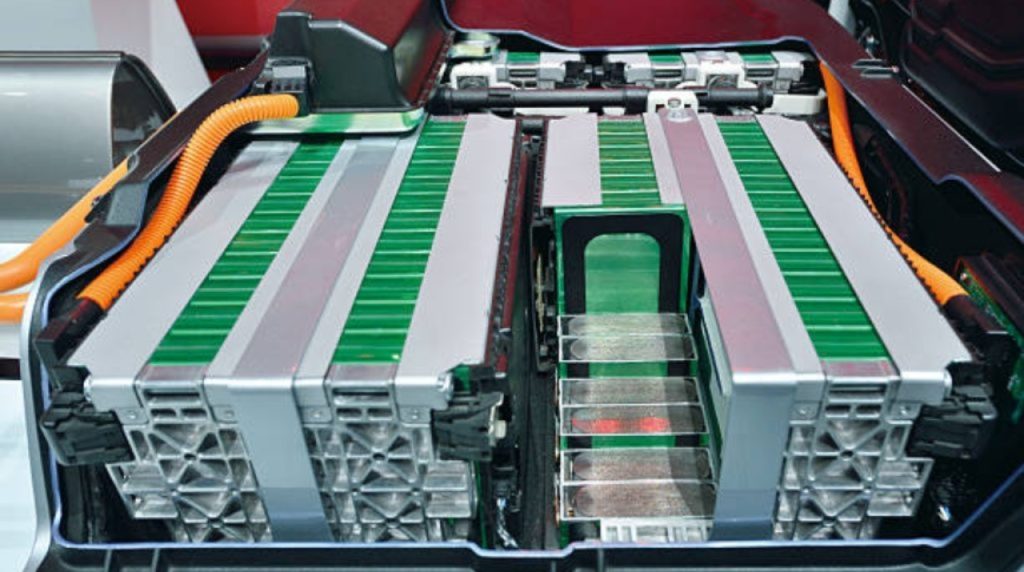

Batteries are currently the biggest cost driver for electric car manufacturers and greatly influence the performance of the final product.

In addition, the supply chain to make them faces a number of hurdles, from the extraction of critical raw materials such as lithium, cobalt and nickel, to battery production and recycling.

You may also read: Toyota anticipates an increase in battery recycling demand

More Data

Despite the difficulties, lithium-ferrophosphate (LFP) batteries are increasing their share of the global market.

According to Bain & Company, in 2018, such batteries accounted for 25-30% of demand in China, a figure that rose to 65% last year and will rise to 70% by 2030. Globally, their share will be 40% of the total by 2030.

Outside China, NMC (nickel-manganese-cobalt) technology will continue to be the most widely used technology in the world, with more than 50% of all batteries, according to the consultancy.

The report rules out that other emerging technologies, such as solid-state and high-density sodium-ion batteries will develop at speed, as they are still in the prototype and pilot manufacturing stages.

Therefore, their share could be in the single digits by 2030. Bain & Company considered that, in the United States and the European Union, LFP batteries will gain market share but will never be dominant, because of import tariffs with China and because domestic LFP production is almost non-existent, reducing their cost advantages.