Latin America Accelerates in Electric Mobility: Challenges and Opportunities for 2026

Electric and low-emission mobility enters a decisive stage in 2026. After a decade of rapid growth driven by incentives, technological innovation, and climate commitments, the sector is beginning to face more complex challenges: infrastructure scaling, business model sustainability, pressure on electricity grids, and the need for more mature public policies.

Globally, transportation continues to account for about 23% of energy-related CO2 emissions, according to the International Energy Agency (IEA), making the decarbonization of mobility a central focus of climate strategies.

In this context, 2026 is shaping up to be a turning point between the early adoption phase and the structural consolidation of change.

You may also be interested in | Electrification, Data, and Partnerships: Latam Mobility Promotes the Future of Transportation on the “2026 Tour”

Global Growth: From Momentum to Adjustment

The global electric vehicle market continues to grow, albeit at a more moderate pace than in the years immediately following the pandemic.

In 2024, more than 17 million electric and plug-in hybrid vehicles were sold worldwide, and projections anticipate new record highs, with Asia, Europe, and North America accounting for most of the volume.

However, the focus in 2026 is no longer just on selling more units, but on integrating electric vehicles into more complex mobility and energy systems, where infrastructure availability, total cost of ownership, and regulatory stability will be key to sustaining demand.

Charging Infrastructure: The Main Bottleneck

The expansion of charging infrastructure is emerging as the biggest cross-cutting challenge for electromobility.

Globally, there are more than 5 million public charging points, but their distribution is highly uneven and their growth is beginning to slow in some mature markets.

In 2026, the debate will focus less on the number of chargers and more on their strategic location, power, interoperability, and operating model.

The lack of fast chargers in urban and logistics corridors, as well as the concentration of points in high-income areas, poses risks for the widespread and equitable adoption of electric mobility.

In Latin America, the gap is even more evident. Brazil, Mexico, and Chile account for most of the region’s public chargers, while other countries are progressing slowly, reinforcing the need for regional planning and clear regulatory frameworks.

Electrification of Public Transportation

One area where Latin America shows global leadership is in the electrification of public transportation.

Cities such as Santiago, Bogotá, São Paulo, and Mexico City have incorporated thousands of electric buses in the last decade, positioning the region as one of the most advanced outside of China.

According to data from the ZEBRA (Zero Emission Bus Rapid-deployment Accelerator) initiative, Latin America now has more than 7,000 electric buses in operation, with cumulative investments exceeding $4 billion.

In 2026, the trend is likely to shift from flagship projects to systemic scales, integrating electric buses with urban planning, green financing, and renewable energy generation.

Fleets and Logistics: The Next Big Leap

Beyond public transportation, 2026 will be key for the electrification of commercial, delivery, and urban service fleets.

Logistics, e-commerce, and shared mobility companies are accelerating the adoption of electric vehicles to meet emission reduction and operating cost optimization goals.

Fleet electrification allows for clearer returns than private vehicles, thanks to predictable routes and centralized charging.

In Latin America, this segment is emerging as one of the main drivers of growth, especially in cities with environmental restrictions and high fuel costs.

Low Emission Zones and Urban Regulation

Low Emission Zones (LEZs) will continue to expand in 2026, especially in large and medium-sized cities. However, the focus is shifting toward effective implementation, enforcement, and social acceptance.

European experience has shown that LEZs without sufficient infrastructure or accessible transport alternatives generate resistance.

For Latin America, the challenge will be to adapt these models to urban contexts with high levels of informality, territorial inequality, and dependence on public transport.

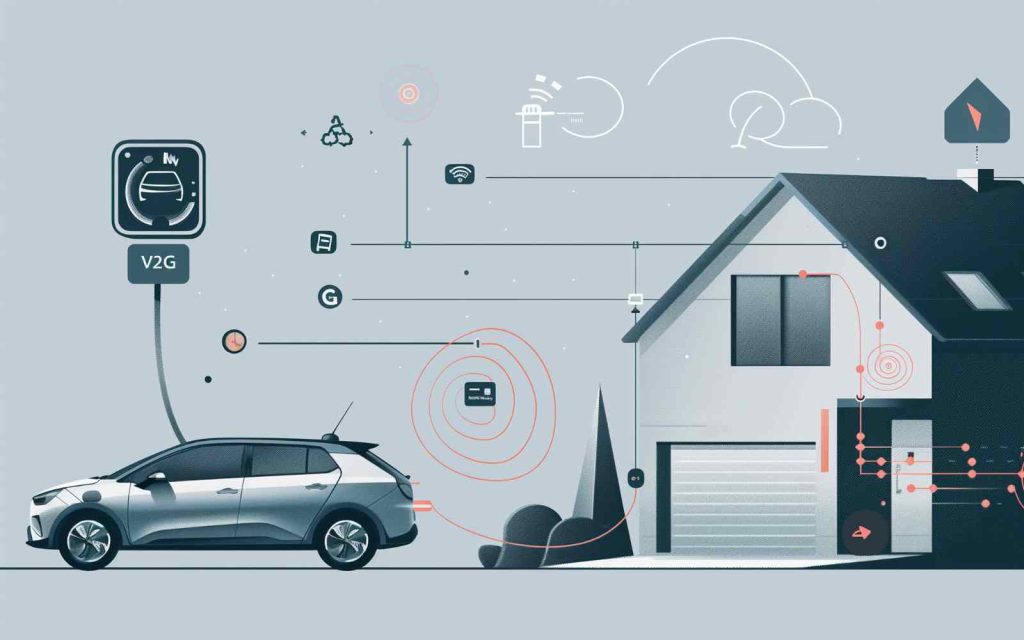

Integration with the Power Grid

Electric mobility cannot grow in isolation. By 2026, integration between transportation and the power grid will be a central issue.

The simultaneous charging of thousands of vehicles poses challenges for grid stability, especially during peak hours.

This is why solutions such as smart charging, demand management, battery storage, and the use of renewable energy at charging stations are gaining relevance.

Technologies such as Vehicle-to-Grid (V2G), although still in their infancy in the region, are beginning to appear in pilot projects and regulatory frameworks.

Public Policies, Financing, and New Businesses

In the most advanced markets, 2026 will mark a transition from direct subsidies to more structural policies aimed at industrial competitiveness, local production, and supply chain resilience.

In Latin America, countries such as Brazil and Mexico are beginning to discuss electromobility not only as an environmental policy, but also as an industrial opportunity linked to manufacturing, assembly, batteries, and electrical components. This approach will be key to attracting investment and generating employment during the transition.

On the other hand, the financial sustainability of electromobility will be another critical issue in 2026. The sector is moving towards service-based models: pay-per-use, battery leasing, energy contracts, and green financing schemes.

Development banks, climate funds, and multilateral organizations will continue to play a key role in Latin America, especially for public transportation and infrastructure, where private capital still perceives high risks.

2026 as a Year of Consolidation

Rather than ambitious announcements, 2026 will be a year for measuring results. Electric and low-emission mobility will no longer be evaluated by the number of pilot projects but will be judged by its ability to operate at scale, reduce real emissions, and improve the quality of urban life.

For Latin America, the challenge will be to capitalize on its experience in electric public transportation, close infrastructure gaps, and build stable policies that allow the transition to be not only green but also inclusive and economically viable.

With the 2026 Tour, Latam Mobility reaffirms its commitment to building a regional agenda that connects vision, public policy, innovation, and the market.

Through its stops in Monterrey and Mexico City, Brazil, Colombia, and Chile, the platform will continue to promote a collaborative approach to accelerate the transition to cleaner, more efficient, and more inclusive transportation systems, positioning Latin America as a relevant player in sustainable mobility at the global level.

Be part of the movement that is accelerating Latin America’s energy and urban transformation. If you would like to learn more about how to participate and positioning options, click here.