The Mexican Automotive Industry Faces Challenges in the Production of Batteries for Electric Vehicles

Almost three years after the approval of the reform to Mexico’s Lithium Law, the national industry still faces significant challenges in developing its own production of batteries for electric vehicles (EVs), evidence that highlights the complex path toward a complete value chain in electromobility within the country.

Despite the progress of the electric automotive market and the potential of national mining, the lack of an integrated battery industry limits Mexico‘s technological autonomy compared to other global players.

You may also be interested in | Latin America Accelerates in Electric Mobility: Challenges and Opportunities for 2026

Industrial Development Expectations

In February 2023, the federal government issued a decree reserving the ownership and exploitation of lithium for the state, with the intention that this strategic mineral would serve as the basis for developing a local high value-added battery industry and thus boost electromobility in the country.

This decision was part of an effort to keep the added value of natural resources within Mexico and create new industrial capacities linked to the automotive sector.

However, recent data show that, to date, no commercial production of batteries for electric cars has been established within the national territory, nor have any major industrial projects materialized that would allow the demand of automakers that manufacture electric vehicles domestically or for export to be met.

Industry experts and analysts point out that, although Mexico has consolidated an important position in the manufacture of conventional and light electric vehicles, the absence of a battery industry represents a bottleneck for the consolidation of a complete electromobility ecosystem.

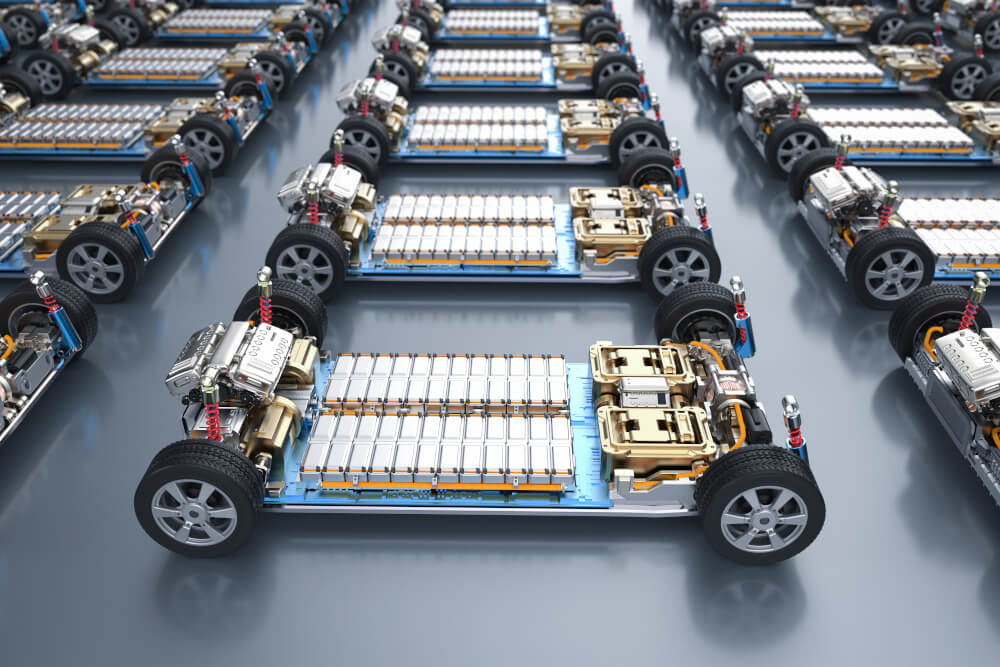

Batteries are one of the most strategic and expensive components of electric vehicles, and their production requires a set of technological and manufacturing capabilities that are not yet fully developed in the country.

The lack of domestic production means that most batteries must be imported from abroad, keeping Mexico dependent on external suppliers, mainly from Asia, for this critical part of the supply chain.

This situation limits the competitiveness of local manufacturers and reduces the country’s ability to influence the prices and availability of these essential components.

Impact on the Supply Chain

The absence of domestic battery production also affects regional integration under the United States-Mexico-Canada Agreement (USMCA), which establishes rules of origin that seek to increase the regional content of vehicles produced in North America.

Batteries can account for between 30% and 40% of the value of an electric vehicle, so the lack of domestic production makes it difficult to fully comply with these requirements and could limit the future growth of automotive manufacturing in the region.

In some northern Mexican states, such as Chihuahua, Coahuila, and Jalisco, there are initiatives to attract battery production projects, partly motivated by the need to strengthen automotive supply chains and meet the regional integration goals stipulated in the USMCA.

However, these efforts are still in their infancy and do not constitute significant industrial-scale production.

The role of critical minerals such as lithium, nickel, and cobalt remains central to the development of advanced energy storage technologies.

Experts have pointed out that, in order for Mexico to meet its electric mobility goals by 2030, it is essential not only to extract these resources, but also to process and use them within the country, which implies investments in infrastructure, human capital, and public-private partnerships.

Despite having potentially exploitable lithium deposits, most of these deposits have not yet been developed commercially, and industrial extraction of the mineral has not yet materialized, complicating the construction of an integrated battery industry.

Urgency of Industrial Strategies

Globally, countries such as China lead the production of batteries for electric vehicles, with decades of public and private investment that has allowed them to consolidate a robust value chain ranging from the extraction of raw materials to the manufacture of battery cells and modules that are competitive in price and volume.

This dominant position highlights the need for Mexico to implement clear industrial policies to attract investment and develop its own technological capabilities.

The creation of regulatory incentives, tax schemes, strategic alliances with international companies, and industrial production pilot projects are some of the mechanisms that could contribute to reducing dependence on imports and strengthening the local battery industry.

These actions could in turn boost the production of electric vehicles in Mexico and promote more balanced development throughout the electromobility ecosystem.

Building an electric vehicle battery industry in Mexico represents one of the most important industrial challenges in the context of the transition to sustainable mobility.

Although domestic production of electric vehicles has shown steady growth, the move toward a fully integrated supply chain, including battery production, is still a pending goal that will require coordinated efforts between the public sector, investors, and the automotive industry.

Overcoming this challenge would not only consolidate Mexico‘s competitiveness in the global automotive industry, but also boost technological development and the creation of highly specialized jobs, positioning the country as a key player in the electromobility economy of the future.

2026: Moving Towards Electric Mobility

Rather than ambitious announcements, 2026 will be a year for measuring results. Electric and low-emission mobility will no longer be evaluated by the number of pilot projects but will be judged by its ability to operate at scale, reduce real emissions, and improve the quality of urban life.

For Latin America, the challenge will be to capitalize on its experience in electric public transportation, close infrastructure gaps, and build stable policies that allow the transition to be not only green but also inclusive and economically viable.

With the 2026 Tour, Latam Mobility reaffirms its commitment to building a regional agenda that connects vision, public policy, innovation, and the market.

Through its stops in Monterrey and Mexico City, Brazil, Colombia, and Chile, the platform will continue to promote a collaborative approach to accelerate the transition to cleaner, more efficient, and more inclusive transportation systems, positioning Latin America as a relevant player in sustainable mobility at the global level.

Be part of the movement that is accelerating Latin America’s energy and urban transformation. If you would like to learn more about how to participate and positioning options, click here.